Any links to online stores should be assumed to be affiliates. The company or PR agency provides all or most review samples. They have no control over my content, and I provide my honest opinion.

Netflix. Amazon Prime. Hulu. Peacock. HBO Now. CBS All Access. What does this long list of names tell you? Well, it might actually tell you a couple of things. The first is that the long process of “cutting the cable” when it comes to how we receive and interact with television has come to an end, and traditional cable TV is rapidly headed for obsolescence. Perhaps the second is the idea that TV viewing figures no longer matter the way they once did because everyone’s consuming their preferred shows and films on their own terms and at their own time. However, the third idea that might strike you is that the market for streaming and subscription services is rapidly approaching saturation point.

Industry analysts have been wrestling with the question of “how many is too many” when it comes to streaming services for some time. Time Magazine performed a deep dive on TV streaming viewing habits at the end of 2020 and concluded that saturation point has already come and gone for many people. Millions of people – perhaps including you – don’t intend to continue with all of their current subscriptions beyond the end of their current commitment. They might also do away with one or two of the subscriptions that they’re not contractually obligated to as well. Paying $5.99 or $9.99 here and there for a subscription felt liberating when we were used to paying ten times that for an old-fashioned TV subscription package. When we have to subscribe to five or six such platforms to access all of the content we want to see, we’re no longer saving any money, and the process of finding that content becomes more arduous.

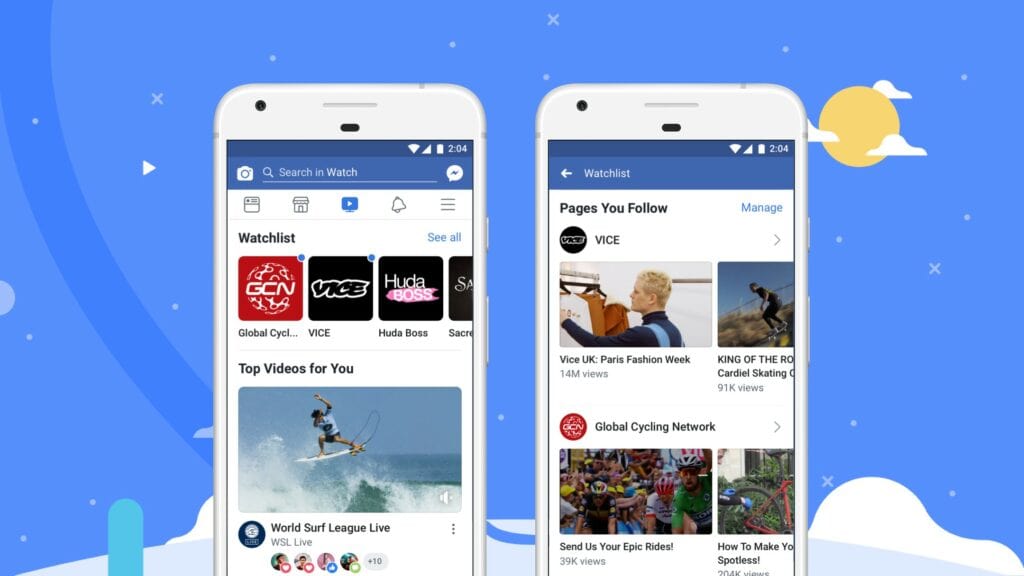

Facebook Watch

You don’t have to be a TV industry professional to see why the addition of more streaming services might be a problem, but TV industry professionals are saying it anyway. Big companies have tried and failed to break into the subscription streaming market within the past couple of years. Facebook Watch was basically dead on arrival and hasn’t shown many signs of life since despite the social media company’s ongoing efforts to resurrect it. YouTube TV hasn’t performed well either. People are willing to pay a small subscription fee to YouTube, but that’s only because they want to watch videos without being interrupted by adverts every two minutes. Original content doesn’t do well on YouTube and never has. Apple hasn’t quite hit on the right idea for Apple TV yet either. If Facebook, Apple, and YouTube are struggling despite having enormous resources to call upon, smaller platforms theoretically have no chance. That doesn’t look like it’s going to stop them trying any time soon, though.

Ad supported Tubi

The latest name into the fray is Tubi, which is a name you might have come across before. It’s a free streaming service and has an audience of a few million people in the United States of America. Right now, it makes its money through advertising. It would like to change that. According to reports that began to circulate on the internet during the third week of March, the people behind Tubi are considering getting involved in original programming. If the reports are accurate, this new initiative will see the company start by funding its own movies and then progress into making its own exclusive television series. Advertisers have already been contacted about their receptiveness to the company’s potential new direction, and those conversations are believed to have gone well. Some reporters even claim that an official announcement on the matter is imminent.

If you’re wondering how a seemingly-small company like Tubi could possibly afford to start investing in movies, the answer is that Tubi isn’t actually Tubi at all. Tubi is the property of the all-powerful Fox Corporation, which paid $440m to acquire it in March 2020. Fox has been looking for a way into streaming for a long time but is conscious of how people feel about the Fox brand. Even in the United States of America, the network is divisive because of its political leanings. Outside the USA, the Fox brand is viewed with disdain. Tubi offers a good vehicle for Fox to get into the streaming business without people necessarily becoming aware that they’re giving money to Fox. When Fox first became involved with the company, the plan was to offer Fox’s historical content for free and maybe add some sports content at a future date. That plan appears to have changed significantly.

The battle between the various different streaming companies can be compared directly with the battle for supremacy between online slots companies for many reasons. Online slots websites operate within a market worth tens of billions of dollars per year, and competition is fierce. The user interface for most TV streaming companies even looks like the layout of an online slots website. In many cases, that’s where the idea of streaming content and presenting it in this fashion came from. The most important issue they can be compared on, though, is that not everyone who gets involved in the contest survives. The bigger online slots companies either find a niche, as we see with roseslots.com and its pursuit of the female market, or try to outdo the competition with promotions, incentives, and enormous advertising budgets. Many betting companies have dipped their fingers in the online slots wars and got burnt. Many TV companies have done or will do the same with streaming – and the cost of failure when TV networks are involved tends to be far higher.

Having the backing of Fox means that Tubi has a better chance of breaking into the market and finding a foothold than the average startup streaming company would, but as we’ve already seen with YouTube and Facebook, big-time backing isn’t a guarantee of big-time success. A lot will depend on the quality of the company’s original output, and how many of the platform’s existing users can be persuaded to stick around if they have to pay for the privilege. The most recent statistics available, which come from the end of December 2020, say that Tubi had a little over thirty million active users. Assuming that half of them can be persuaded to stick around – which is far too optimistic – that would yield fifteen million subscribers. Netflix currently has around two hundred and ten million. Halving the number of users would result in a dip in Tubi’s advertising revenue, currently estimated at $300m per year. It’s hard to see how Fox can make the numbers add up, and it might be the case that they’re prepared to take a loss in the first couple of years while they try to get their premium version of Tubi off the ground, but it may already be too late for another company to enter the race. We’d be surprised and delighted to be proved wrong on this, but we won’t hold our collective breath.

[xyz-ips snippet=”ScraperCaptcha”] |

I am James, a UK-based tech enthusiast and the Editor and Owner of Mighty Gadget, which I’ve proudly run since 2007. Passionate about all things technology, my expertise spans from computers and networking to mobile, wearables, and smart home devices.

As a fitness fanatic who loves running and cycling, I also have a keen interest in fitness-related technology, and I take every opportunity to cover this niche on my blog. My diverse interests allow me to bring a unique perspective to tech blogging, merging lifestyle, fitness, and the latest tech trends.

In my academic pursuits, I earned a BSc in Information Systems Design from UCLAN, before advancing my learning with a Master’s Degree in Computing. This advanced study also included Cisco CCNA accreditation, further demonstrating my commitment to understanding and staying ahead of the technology curve.

I’m proud to share that Vuelio has consistently ranked Mighty Gadget as one of the top technology blogs in the UK. With my dedication to technology and drive to share my insights, I aim to continue providing my readers with engaging and informative content.