Any links to online stores should be assumed to be affiliates. The company or PR agency provides all or most review samples. They have no control over my content, and I provide my honest opinion.

For a lot of younger investors, real-estate investments and buying stocks no longer seem as satisfying or secure. The memories of 2008 are still engraved in the minds of many, and these images won’t evaporate anytime soon.

At the same time, you’re tech-savvy, which means that you’re quicker to embrace new technologies than others, which means that you’ll be quicker to notice growing tech trends. As an investor, this can give you a significant edge and a window of opportunity to make some real money.

Lastly, it’s really nice to feel like you’re putting your money towards the advancement of all humankind. With all of that in mind, here are the top six lucrative ideas for tech-savvy investors in 2024.

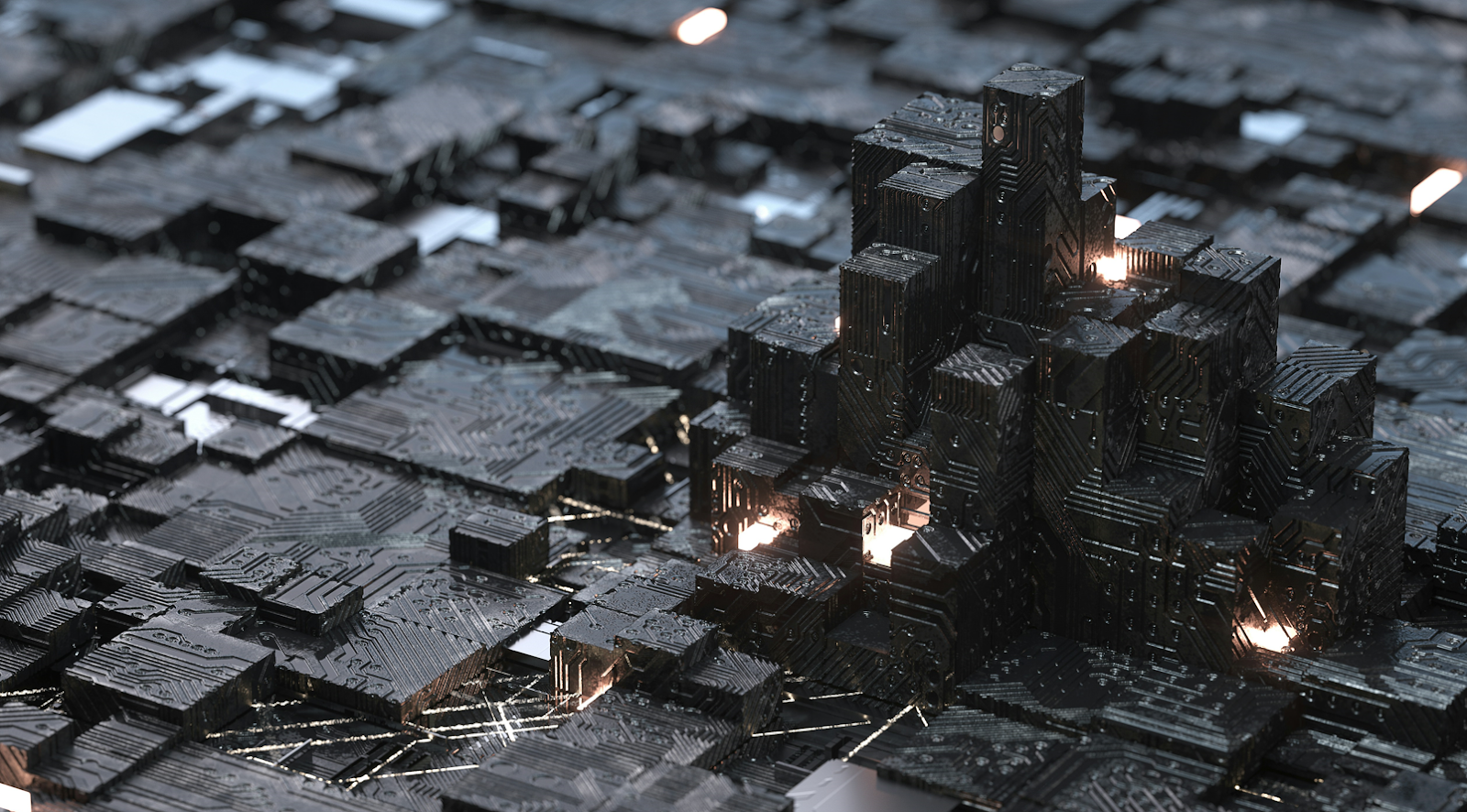

1. Cryptocurrencies

Getting into cryptocurrencies doesn’t always require a huge investment, making them accessible entry points for tech-savvy investors. Also, even with a modest buy-in, the growth potential can be immense. Some coins skyrocket overnight, which, while risky, makes this market tempting for those seeking high rewards.

With a pro-crypto leader in office, regulations will likely favor the crypto market. This could encourage more institutions to enter the space. Moreover, investor confidence is growing with the government backing digital assets, creating a favorable environment for crypto to thrive.

Cryptocurrencies don’t stand alone; they’re interconnected with revolutionary tech like blockchain and decentralized finance (DeFi). You’re not just investing in a currency; you’re supporting a whole network of tech advancements. Also, as more industries adopt these technologies, crypto’s role in the economy keeps expanding.

The fun side of crypto, meme coins, is that they can be surprisingly profitable if you pick the right one at the right time. Looking for the best meme coins to buy now is nothing other than betting on viral trends. However, it’s crucial to distinguish promising coins from those without long-term value – trend awareness is essential here.

2. Green tech innovations

Sustainability isn’t a passing trend – it’s here to stay. With climate change in focus, green tech is a top priority worldwide. Also, consumers and governments are demanding greener solutions, which means investing in sustainable technology isn’t just ethical – it’s financially smart.

Many governments offer grants, tax breaks, or subsidies for green tech development. This makes it easier for startups to innovate without financial strain. For investors, these incentives mean lower risks and more attractive returns. Moreover, it shows that there’s strong institutional support for sustainable innovation.

Eco-tech is growing fast, especially in areas like solar power, electric vehicles, and energy storage. With advancements in material and efficiency, new opportunities are constantly arising. Also, the urgency of the climate crisis ensures that these technologies won’t lose relevance anytime soon.

Solar and wind technology are becoming more efficient and affordable. Moreover, global solar photovoltaic capacity has grown from around five gigawatts in 2005 to 1.6 terawatts in 2023. As these improvements continue, green tech becomes more accessible for consumers and businesses. Moreover, with these advancements, energy sectors reliant on fossil fuels face disruption, further positioning eco-tech as a lucrative investment.

3. Blockchain in supply chains

Blockchain technology allows every transaction and process in a supply chain to be traced back easily, creating unprecedented transparency. Also, because it’s decentralized and tamper-proof, blockchain adds a layer of security, reducing fraud and ensuring that logistics run smoothly and accountable.

Using blockchain in supply chains cuts out intermediaries, automating and simplifying processes. This means fewer bottlenecks and lower costs. Moreover, automation through smart contracts can make the entire chain more efficient, allowing companies to spend less on paperwork and focus on actual delivery.

Major companies are already implementing blockchain for logistics, which speaks volumes about its reliability. As more industry giants adopt it, smaller companies will likely follow suit, driving demand for blockchain solutions. Also, this broader adoption could increase the value of blockchain-focused companies.

Blockchain isn’t just about crypto anymore; it’s becoming the backbone for various applications, especially in logistics. Besides tracking goods, blockchain can authenticate products, reduce counterfeiting, and ensure compliance. Also, as these use cases expand, investors will find more avenues to explore within blockchain.

4. Artificial intelligence startups

With companies like Samsung and HONOR unveiling their AI-driven devices, it is clear that the mainstream tech industries have more than adopted the technological concept, which makes it an even better idea for small investors. However, instead of putting money in major companies, why not look for artificial intelligence startups and maximize your profit?

Artificial intelligence is no longer confined to tech firms; it’s being adopted in finance, healthcare, and retail. This widespread application signals massive growth potential. Also, as AI evolves, companies across sectors need smarter solutions, so investing in AI startups is an exciting diversified opportunity for tech-forward investors.

Demand for AI tools, from chatbots to data analytics platforms, is booming. Businesses want tools that help them work faster, smarter, and more cost-effectively. Moreover, this demand for innovation shows no sign of slowing down, which means AI startups have a steady market to tap into.

With AI becoming a core component of digital transformation, AI-focused startups can deliver impressive returns. Early-stage investments in AI companies can yield high ROI as these businesses scale. However, it’s worth noting that picking the right startup with scalable technology is key to success in this area.

When big tech companies shout for promising AI startups, it signals market validation. These acquisitions aren’t just about resources; they’re strategic moves to integrate groundbreaking AI technology. For investors, this trend hints at potential buyouts, which could translate into significant returns for early adopters.

5. 5G infrastructure and expansion

5G networks offer faster data speeds, enabling seamless mobile streaming and more complex IoT devices. With 5G, you’ll see more smart home tech and advanced mobile applications. Also, the speed and reliability of 5G pave the way for innovations across multiple sectors.

Smart cities rely on 5G to function efficiently, from connected traffic lights to security systems. As cities grow more interconnected, the demand for 5G infrastructure rises. Moreover, this development has a ripple effect, creating investment opportunities for companies that provide these essential services.

5G isn’t just for urban areas; rural communities have a growing need for fast, reliable internet. With expanding coverage, companies can reach underserved regions. Also, this demand offers unique investment opportunities for firms working to bridge the digital divide with 5G technology.

The 5G rollout requires towers, cables, hardware, and data management services. This makes the ecosystem highly diverse, giving investors options across infrastructure and services. Moreover, as 5G adoption accelerates, there’s potential for growth in each area, making it a promising sector to consider.

Leveraging your technology aptitude for profit is the way to go

Whether you’re eyeing cryptocurrencies, green tech, or 5G, each area can potentially redefine our daily lives. Moreover, the great part about being a tech-savvy investor is knowing you’re supporting ideas that could drive progress. Also, you’re diversifying your portfolio with options that go beyond the ordinary. So, as you explore these opportunities, remember that investing in technology is about staying ahead.

I am James, a UK-based tech enthusiast and the Editor and Owner of Mighty Gadget, which I’ve proudly run since 2007. Passionate about all things technology, my expertise spans from computers and networking to mobile, wearables, and smart home devices.

As a fitness fanatic who loves running and cycling, I also have a keen interest in fitness-related technology, and I take every opportunity to cover this niche on my blog. My diverse interests allow me to bring a unique perspective to tech blogging, merging lifestyle, fitness, and the latest tech trends.

In my academic pursuits, I earned a BSc in Information Systems Design from UCLAN, before advancing my learning with a Master’s Degree in Computing. This advanced study also included Cisco CCNA accreditation, further demonstrating my commitment to understanding and staying ahead of the technology curve.

I’m proud to share that Vuelio has consistently ranked Mighty Gadget as one of the top technology blogs in the UK. With my dedication to technology and drive to share my insights, I aim to continue providing my readers with engaging and informative content.